Summary

GReg is a comprehensive regulatory risk management solution, tailored to EU regulation. It offers low cost and low maintenance regulatory automation. A proof of concept can be deployed at customer premises within 2 weeks.

GReg is backed by a development and deployment team that brings along an average experience of 12 years in data, technology and risk regulatory topics in the financial services market.

Efficiency is a key factor to success in a competitive market, that’s why this solution provides:

- a proven, comprehensive, powerful and integrated analytical platform that can be working within a few weeks

- seamlessly integrated data reconciliation from different sources to produce accurate predefined or custom-made management reports which are accessible in real-time

- automated processes that turn manually prepared jobs into streamlined complex reporting, putting you in control of your management reports.

In addition to its regulatory purpose, GReg could also provide a platform for analytical customer relationship management, churn modeling, risk management and scorecard development to help banks better understand their customer behavior.

*GReg has been built for European banking and finance regulations, however it can be easily extended and adapted to fit regulations in other markets such as Australia, New Zealand and Singapore.

Problem

Regulators are increasingly wary of the way financial institutions handle their data and resulting accuracy of asset valuations, provisions, and economic capital.

Most financial organizations doing business in Europe have hastily implemented technology solutions for new regulatory requirements like BCBS 239, IFRS 9 and others in the past three years.

Those solutions are “first generation” of risk data analytics and capital requirements tools that allowed financial institutions to achieve “good enough” compliance, but struggle with issues like high maintenance costs, inflexibility to adjust to new regulations, or allow users to make changes.

Benefits

After 3 years of development and continuous improvements the result is a field tested product built on standard technology components that:

- put users in control of the whole reporting cycle

- offers robust data audit process

- provides the infrastructure to apply BCBS 239 rules

- can be implemented on premises or on cloud within 2 months

- allows customer specific enhancements and functionality to be developed and deployed within 2-3 weeks.

SOLUTION

GReg surpasses competitive solutions in breadth of functionality, flexibility, and low maintenance costs. A proof of concept can be deployed on premises or executed remotely in the cloud within 4 weeks.

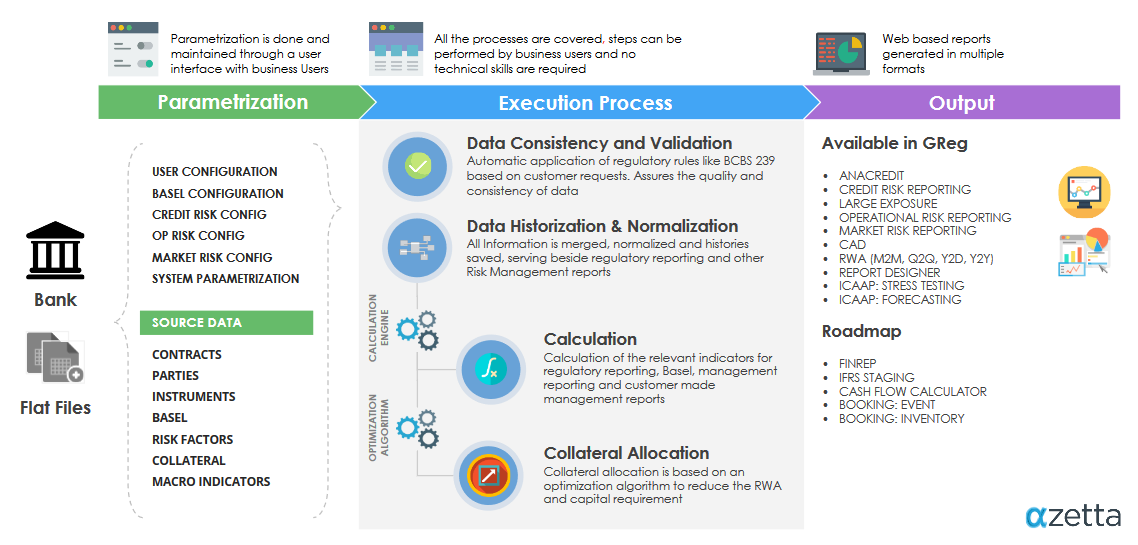

GReg’s Process and Main Components

What’s in the Development Pipeline for GReg?

RRS is continuously being improved. New features and enhancements are being developed. The current development pipeline includes:

- Leverage ratio: C40.00 – C44.00, C47.00

- MKR Market Risk: All remaining market risk reports

- Forecasting

RRS is continuously being improved. Market and customer requirements drive the development pipeline. Current requirements are being reviewed:

- Liquidity coverage reporting

- Part I – Liquid assets -Liquidity coverage – liquid assets

- Part II – Outflows

- Part III – Inflows

- Part IV – Collateral swaps

- Stable funding reporting Part V

- Stable funding – Items requiring stable funding

- Stable funding – Items providing stable funding

- IFRS 9

OUTCOMES

After only 2 months implementation period, your regulatory reporting environment will be robust and capable:

- achieve compliance with COREP, Anacredit and ICAAP

- you’ll have the flexibility to create and deploy new regulatory reports on premises within 2-3 weeks

- lower maintenance costs than competitive solutions.